According to Bankrate, the average driver in the U.S. pays $1,655 per year for auto insurance. That comes out to $138 per month! There’s no denying that car insurance is a major expense for many Americans.

Are you unknowingly leaving money on the table with your auto insurance? In the maze of premiums and policies, a treasure trove of hidden discounts awaits, poised to slash your rates significantly. This guide reveals 28 overlooked auto insurance discounts that could unlock substantial savings on your policy.

From loyalty perks to safety feature bonuses, we dive deep into each discount, explaining how you can qualify and capitalize on these savings opportunities. Whether you’re a seasoned driver or a new policyholder, this article is your roadmap to reducing your insurance expenses without compromising coverage. Join us as we uncover the secrets to a more affordable auto insurance policy.

OK, so none of these are really hidden. But auto insurance companies don’t usually advertise them, which can make it easy to miss potential savings. If you’re trying to save money on your car insurance, read on to see if you qualify for any of these common discounts you may not have heard about.

Traffic school can help you keep a clean driving record, prevent insurance increases, and more!

Auto Insurance Discounts for Your Driving History and Habits

1. Safe Driving Discount

Most auto insurance providers offer discounts to safe drivers. This can happen a few different ways: You may be eligible for a discount by staying accident- and ticket-free for a specific amount of time, or you may be asked to download a smartphone app that records data as you drive.

This is known as a California Good Driver discount, which is mandated by the state and guarantees you savings of at least 20%.

Here are the California Good Driver Discount Rules:

- They must have continuously held a driver’s license for a minimum of three years.

- They must have one or fewer points on their driving record.

- They must not have been to traffic school more than once.

- They must not have been involved in any at-fault accidents that resulted in injury or death.

- They must have no DUI-related convictions within the last ten years.

Some auto insurance companies even offer both kinds, so if you’re a safe driver and don’t mind providing smartphone data to your insurance company, you could be eligible for several discounts.

2. Low Mileage Discount

Most insurance companies design their policies based on averages — for example, the average U.S. driver drives about 13,500 miles per year.

Eligibility for a low mileage discount can vary significantly among insurance providers. Generally, drivers who clock fewer than 7,500 miles annually are prime candidates for this discount. However, thresholds can differ, with some companies setting the bar at under 12,000 miles per year, while others may consider 10,000 miles or less as qualifying criteria. The definition of “low mileage” isn’t set in stone and can range from 7,500 to 15,000 miles annually, depending on your insurer.

Savings from low mileage discounts can be substantial, ranging from 5% to as much as 30% off your standard premiums, depending on the insurer and your specific circumstances. The Consumer Federation of America indicates that reducing your annual mileage could lead to savings of 5% to 10% on your car insurance rates, particularly if you drive less than 10,000 miles annually.

To qualify, some insurance providers will ask you to submit proof of your car’s total miles at the beginning and end of the year. Others may ask you to use a smartphone app that sends them data about your driving distances.

3. Driving Habit Discount

Certain good driving habits might qualify you for discounts on your insurance premiums. If you and your passengers always wear your seatbelts, for example, some companies offer discounts on the medical payment or personal injury protection portion of your plan. This is because wearing a seatbelt increases your safety behind the wheel, lowering the odds that you’ll be seriously injured in a crash, requiring your insurance to pay out for medical benefits.

Auto Insurance Discounts for Vehicle Equipment

While top-of-the-line safety equipment often comes standard on newer vehicles, many carriers offer discounts for having specific safety equipment installed. You may be eligible for a discount if your car has:

- Airbags

- Anti-Lock Brakes (ABS) – Some states, such as Florida, New Jersey, and New York, mandate discounts for vehicles with ABS. In other locations, it’s at the insurer’s discretion. These discounts can apply to liability, PIP, medical payments, and collision coverages.

- An anti-theft system or alarm

- Passive restraints, or seat belts that fasten automatically when the car is turned on

- Daytime Running Lights – While not as common, some insurers provide discounts for vehicles with daytime running lights, affecting liability, PIP, medical payments, and collision coverage, usually by 5% or less.

1. New Car Discount

Because they’re the most likely vehicles to have the latest and greatest safety and security features installed, newer vehicles can earn you a discount on your insurance premiums. Contact your insurance provider to find out if they offer a discount to drivers with newer cars, and what model years qualify for savings.

Auto Insurance Discounts for Payments and Finances

1. Continuous Coverage Discount

If you maintain your auto insurance continuously over time, you may be entitled to a discount for being a safe and responsible driver. Even if you switch insurance providers, you may be able to qualify for a discount on your new plan by providing proof that you’ve maintained continuous coverage for a period of time specified by your provider.

2. Pay In Full Discount

If you pay for your entire annual insurance plan at once, or even make two payments per year every six months, rather than paying every month, you may qualify for a discount. Many insurance providers offer better rates to drivers who pay for an entire year in advance, rather than pay for a month of coverage at a time.

3. Auto Pay Discount

The same goes for drivers who set up auto pay for their insurance premiums. Some insurance providers offer a discount if you set up auto pay, allowing them to automatically deduct your premiums when they come due, rather than sending you a bill and waiting for you to pay it. There may even be added discounts if you combine auto pay with paperless billing.

4. Advance Purchase Discount

Another common way to score a discount on your premiums is by renewing your policy — and paying for it in full — before it’s set to expire. Different auto insurance providers have different requirements for this discount, but many will offer a percentage off your premiums if you renew your policy and pay for it at least a week before it’s set to expire.

5. Good Credit Discount

This isn’t so much a hidden discount as it is just a financial rule of thumb: You can generally get better auto insurance rates when you have good credit. Improving your credit can be a difficult and time-consuming process, but it’s likely to pay off — in addition to lower car insurance rates, good credit means you’ll qualify for better rates on any type of loan you might take out.

Auto Insurance Discounts for Types of Drivers

1. Good Student Discount

If you have any drivers in your household who are currently in school, good grades can pay off in the form of auto insurance discounts. Studies show that students who make the good choices required to get good grades in their classes are likely to also make good choices behind the wheel, leading many insurance providers to incentivize them with rate discounts. You may need to submit a report card to your insurance provider each semester or quarter to prove that you’re maintaining their minimum GPA for receiving a discount.

2. Resident Student Discount

This is a discount for parents of students. If you have a student in your household who goes away to a college in another city and doesn’t take a car with them, you may be eligible for substantial discounts to your premiums. This ensures that the student driver stays on your plan and has coverage when they come home for holidays and school breaks, but that you don’t have to pay for them to be covered while they’re away at school and not driving.

3. Club Discounts

Belonging to certain clubs and organizations may entitle you to a discount on your auto insurance. Different insurance providers offer discounts for members of AAA, AARP, even Mensa! If you belong to any clubs or organizations, it’s a good idea to contact your auto insurance provider to see if they offer a discount to members, or even shop around to see if any other insurance providers do.

4. Military Discount

Similarly, a number of insurance providers offer discounts to active members of the U.S. military. Some also offer discounts to veterans, or special plans for drivers who are deployed or away from home for training. If you’re an active duty member or veteran of any service branch, it’s not a bad idea to contact your auto insurance provider to see if you qualify for any discounts.

5. Senior Discount

Blue Plate Specials aren’t the only way for seniors to save some cash. Some auto insurance providers offer discounts for mature drivers who complete a DMV Approved Mature Driver Improvement Course, especially those who drive less because they’re retired or living in an assisted care facility.

6. Federal Employee Discount

If you work for the U.S. government, it could save you some money on your auto insurance. Certain carriers offer discounts to federal employees. In fact, if you work in any sort of public service position, it’s worth asking if it qualifies you for a discount. Some auto insurance providers offer small discounts to teachers, healthcare workers, and more.

7. Marriage Discount

Studies show that married people are more likely to be safe drivers than single people, and auto insurance providers have taken notice. That’s why many of them offer discounts to married drivers, or lower rates if you ensure two married drivers from the same household. Since married people tend to be safer drivers, the likelihood of a big insurance payout is smaller, which is why insurance companies are willing to discount their rates.

8. Homeowner Discount

The same goes for homeowners. Insurance providers generally see people who own their own homes as more responsible, and therefore, some offer a percentage off their premiums — just for owning a home, not necessarily for bundling your home and auto insurance (though that can sometimes help you qualify for even lower rates — more on that below).

Auto Insurance Discounts for Driver Education

1. Defensive Driver Discount

Many insurance providers are willing to offer discounts to drivers who are proactive about staying as safe as possible behind the wheel. That’s especially true for drivers who take a defensive driving course. These courses can often be completed online in as little as a few hours, making them a great way to save some money on your monthly premiums.

2. Traffic School Discount

Another way to save money? Online traffic school. Traffic school courses in most states are the same as defensive driver courses — only you typically take a traffic school course after you’ve received a ticket to prevent your insurance rates from going up. If you receive a point on your license in California, ask your court about masking it by going to traffic school. It’s affordable, fast, and fun.

Auto Insurance Discounts for Customer Loyalty

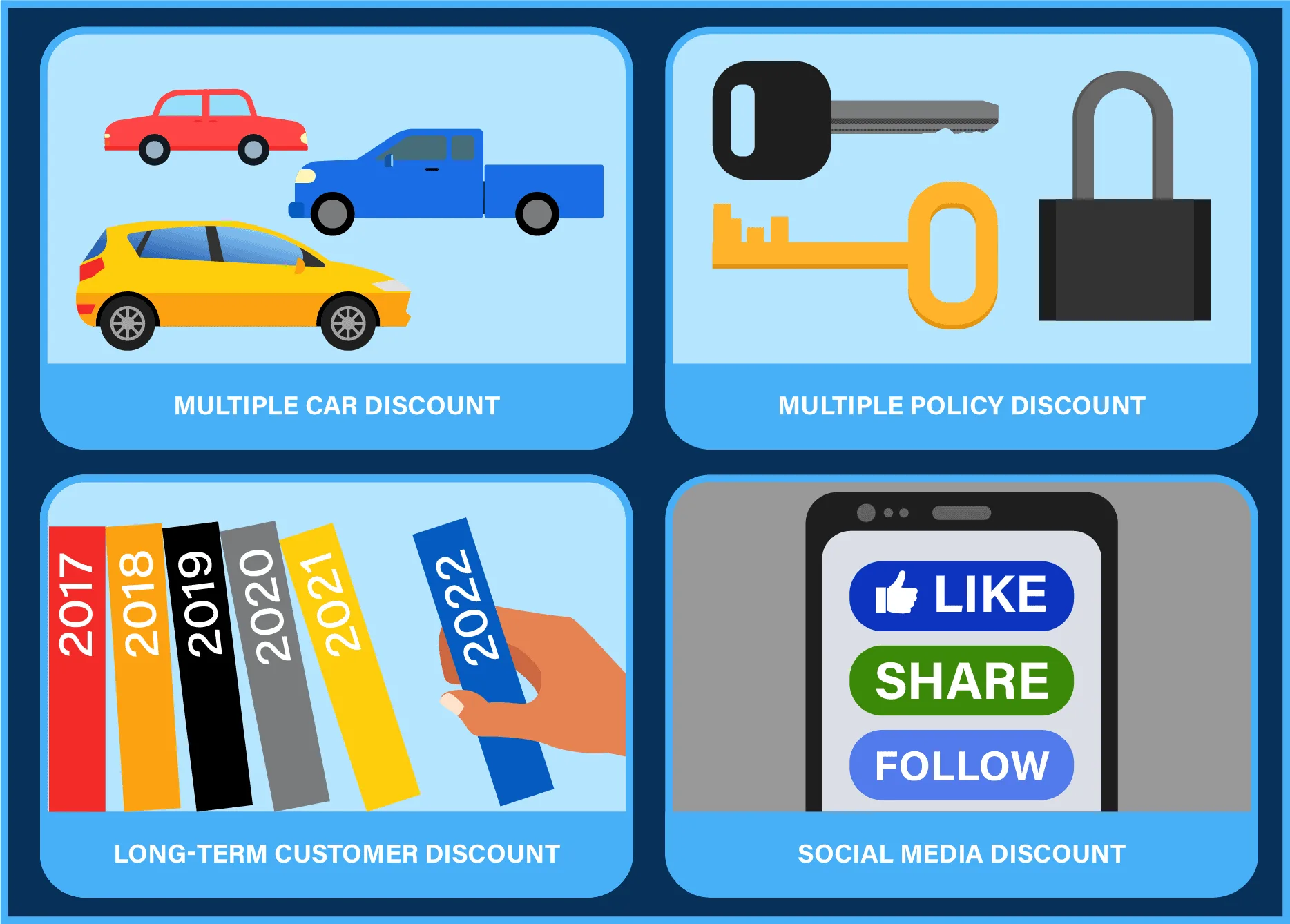

1. Multiple Car Discount

If you own more than one vehicle, getting insurance for all your cars through the same provider can help you save! Many insurance carriers offer discounts for drivers who insure multiple vehicles, including a vehicle for each driver in the same family.

2. Multiple Policy Discount

If you need more types of insurance than just car insurance (say, homeowner’s or renter’s insurance), you might be able to save money by building a bundle with your carrier. Most insurance carriers are willing to offer discounted rates if you stick with them for multiple different types of policies.

3. Long-Term Customer Discount

If you’ve been with your insurance company for a while, it might be time to ask about a loyalty discount. Many insurance companies are willing to give discounts to long-term customers, even if that’s not something they advertise. Even if they say no at first, mentioning that you’re shopping competitors’ rates might convince them to offer you an incentive to stay, especially if you’ve been a good customer by paying your premiums in full and on time.

4. Social Media Discount

Sometimes, all it takes to get a discount on your insurance is a few clicks of a mouse or taps on your phone. In the digital age, as insurance companies try to reach new potential customers online, some carriers offer discounts for doing certain actions on social media. You might be able to score a small discount for following your insurance provider’s social media page, signing up for their email list, or sharing content on your social media.

The Secret to Getting the Best Auto Insurance Rates

There are so many auto insurance rates out there — and they all differ by insurance company. That’s why the best way to make sure you’re getting the best rates is to simply ask for a list of all the discounts your carrier offers. Then, you can see if you qualify for any, or compare discounted rates with other carriers to make sure you’re getting the best deal. You should also note that getting a traffic ticket can impact your insurance rates – so keep your driving record clean!